-

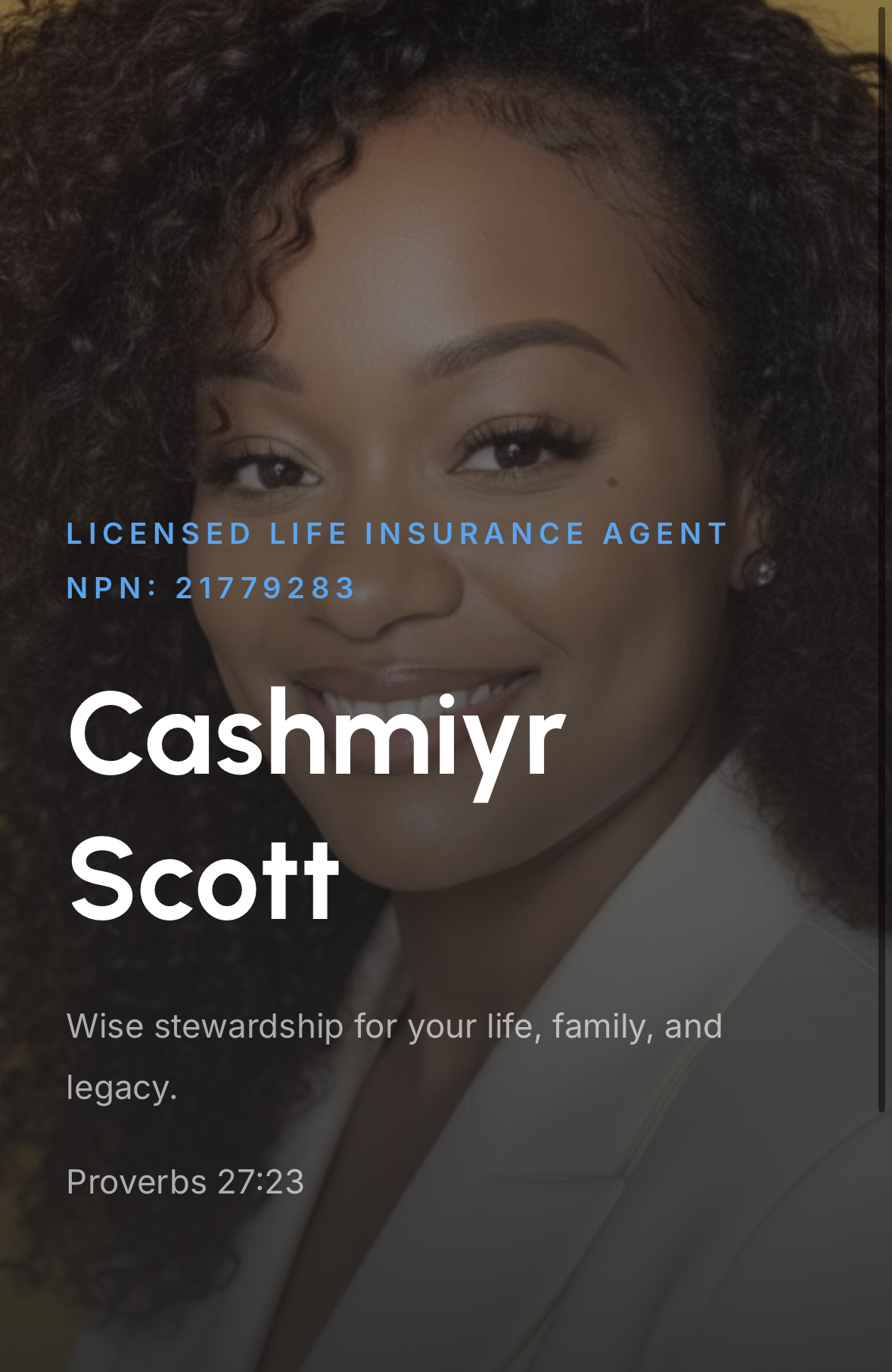

My name is Cashmiyr, and my understanding of life, responsibility, and preparation began very early in life.

At just 10 years old, my family’s life changed in a way none of us could have planned for. After my mom gave birth to my younger brother, she was struck with a mystery illness that would disable her for the rest of her life.

At seventeen years old, I entered adulthood through military service. I joined the Army during a time of active conflict and spent my earliest adult years surrounded by loss, uncertainty, and this solidified the reality that life does not always follow a predictable path. Many of the people I entered service with did not make it home after their deployments. That experience shaped how I see time, family, and responsibility, and it has stayed with me ever since.

When I returned to civilian life and began building, those early experiences never fully left my awareness. I became a mother, my mom’s health worsened and I saw firsthand how easily people can fall outside of traditional systems of protection. My own mother’s health made it clear that many families cannot rely on standard options or assumptions. Planning is not always simple, and it is NEVER one size fits all.

-

As I moved further into adulthood, I began to understand the financial reality facing families who live ordinary, hardworking lives. There are more people now than in years past working in retirement. They are doing the best they can with what they have. Yet the desire is the same. To be stable. To pass down something meaningful. To avoid leaving the people they love with hardship instead of help.

Through life insurance and legacy planning, I realized there was a way for families like ours to create a real inheritance. Not through excess or wealth accumulation, but through intention. A way to ensure that if something were to happen, children are not left carrying only grief, but are supported with stability, care, and the ability to move forward. For many parents, the thought of leaving behind a financial burden is heavier than the thought of loss itself. I understand that deeply.

Over time, I also became aware of how fragile financial security can be. Illness, injury, or unexpected events can undo years of work in a matter of months. Too many families lose everything they have built, not because they were irresponsible, but because they were unprotected. Life insurance is not only about what happens when death occurs. It is also about protecting what is being built while life is still unfolding.

-

Before entering life insurance and legacy planning, I spent eight years serving women through my business, Chloe Maddison Skin. Thousands of people entrusted me with something deeply personal. That work required care, precision, and integrity, and it mattered to me in a very real way. Over time, I began to feel called toward a form of service that could extend beyond a single moment or individual. I wanted to help families in a way that reached further.

Life insurance became full circle.

This work allows one thoughtful decision to protect what families are building today while also caring for the people who will carry that legacy forward. It offers living benefits when hardship strikes and continuity when life changes without warning. It is another expression of the same heart of service, now applied in a way that multiplies its impact.

JCM Legacy Collective is named after my children, Jaedyn, Chloe, and Maddison. They are my legacy and the constant reminder behind every family I have and will serve. I approach this work with seriousness and care, knowing that the choices made here carry real weight. The cost of living continues to rise. The cost of loss continues to rise. Preparation is no longer optional for many families.

This career is not about selling you a product. It is about helping you steward what has been entrusted to you. It is about guiding you to clarity and responsibility, and helping you transfer the risk of the inevitable off of your shoulders and onto proven systems designed to carry that weight. It is about protecting your family’s lives, your years of work, your children, and even the people who depend on you, from being undone by circumstances no one plans for.

In my appreciation for wisdom and stewardship, this biblical principle has greatly influenced how I approach my work and my finances.

“A good person leaves an inheritance for their children’s children.”

Proverbs 13:22Guiding you in the decision to protect yourself and your family is a privilege. I am honored to walk with you into making the most selfless decision of your life.

CASHMIYr’S attention to detail and commitment to fully understanding what i needed was so appreciated by my husband and i.

We’ve already recommended her to many of our friends and family. Thank you For Getting US on the right path to retirement.

—Former Customer